Intro: Impact investing refers to the process of investing in businesses or projects that generate social and environmental impact alongside financial returns. In India, the concept of impact investing is gaining momentum as an increasing number of investors and entrepreneurs seek to combine business and social goals. One of the key areas of focus for impact investing in India is the rural sector. A significant proportion of India's population lives in rural areas, and there is a growing need for investment in agriculture, rural infrastructure, and access to basic services such as healthcare and education. Impact investors are targeting these areas by supporting microfinance institutions, agri-businesses, and social enterprises that provide rural communities with affordable products and services. Impact investing is also being used to address social issues such as poverty, healthcare, and education. Investors are backing social enterprises that provide affordable healthcare services, education programs, and financial products to low-income communities. Additionally, impact investing is helping to bridge the gap between traditional finance and social entrepreneurship, creating a new model for sustainable development.

1.2 - Non-Profit Organisation

A non-profit organization (NPO) is a type of entity that is formed for social, charitable, or educational purposes, with no profit motive. In India, NPOs are governed by the Indian Trusts Act, 1882, the Societies Registration Act, 1860, and the Companies Act, 2013. NPOs in India are also known as Non-Governmental Organizations (NGOs) or Civil Society Organizations (CSOs).

NPOs in India work in a variety of sectors, such as education, health, poverty alleviation, environment, human rights, and disaster relief. These organizations are driven by a mission to improve the lives of people and communities. They operate on a not-for-profit basis, and any surplus generated is reinvested in the organization's work. NPOs in India are required to register themselves with the relevant authorities, such as the Registrar of Societies or the Income Tax Department. They are also required to maintain proper accounting and financial records and file annual returns with the relevant authorities.

NPOs in India are funded by a variety of sources, such as grants from government agencies, philanthropic donations from individuals and corporations, and income generated from their own activities. Social purpose organizations in India are non-profit entities that aim to address social problems, promote social welfare, and improve the lives of marginalized communities. These organizations work towards achieving a social mission and are driven by the desire to bring about positive social change.

The social purpose sector in India is diverse and includes a range of organizations such as non-governmental organizations (NGOs), charities, trusts, foundations, and social enterprises. These organizations work on a variety of issues including education, health, gender equality, human rights, poverty alleviation, environmental conservation, and community development.

Many social purpose organizations in India are founded and led by individuals who have a deep commitment to the cause they are working towards. In recent years, the Indian government has also recognized the role of social purpose organizations in promoting social welfare and has taken steps to encourage their growth and development. The government has created a favourable policy environment for social enterprises and has introduced various schemes and initiatives to support the work of NGOs.

1.3- Social Stock Exchange

The concept of a Social Stock Exchange (SSE) is relatively new, with the first SSE launching in 2013 in London, United Kingdom. The SSE is a platform that brings together social impact-driven companies and investors looking to support businesses with a social and environmental mission.

The idea of the SSE emerged from a growing interest in impact investing, which seeks to generate social and environmental benefits alongside financial returns. Impact investors recognized the need for a marketplace where socially responsible businesses could raise capital, and the SSE was born to fill that gap.

The London SSE was launched in June 2013 as a joint venture between the UK-based social enterprise organizations. The platform was designed to help social enterprises and charities raise capital by issuing bonds or shares to impact investors.

Since then, several other Social Stock Exchanges have emerged around the world, including exchanges in Canada, Brazil, and India. Each exchange has its unique features and focus areas, but they all share a common goal of connecting investors with socially responsible businesses.

The Social Stock Exchange concept continues to gain popularity as the demand for socially responsible investing grows. It provides an opportunity for investors to align their investments with their values, while also supporting businesses that are committed to creating positive social and environmental change.

Indian markets might soon witness the launch of social stock exchanges, which enable investors to make impact investments. The social exchange platform is an innovative technique to involve public participation in social concerns through the equity route. In Budget in July 2019, Finance Minister Nirmala Sitharaman suggested a social stock exchange for social businesses and volunteer groups working for social welfare to assist them obtain money through debt, equity and mutual fund. The major purpose of the Sustainable Stock Exchanges program is to stimulate sustainable investing by strengthening business transparency and performance on ecological, social and governance factors.

During the last two decades, social stock exchanges (SSEs) have evolved as a feasible funding channel for non-profit organizations and for-profit social enterprises. SSEs have previously worked across the impact financing range, from fundamental grants to innovative finance to impact investing. SSEs have been developed all over the world to steer resources and money into social organizations. Their form and design, however, have varied according on the maturity level of financial and philanthropic ecosystems, business sector engagement in social and environmental development, and the government's role in regulating the social sector.

As India, the world's largest democracy, prepares to build an SSE tailored to the needs of the Indian organizational ecosystem, a comprehensive examination of the experiences, structures, and lessons learned from SSEs around the world can help civil society, policymakers, and the private sector create a more enabling environment for social organizations. This stock market is supervised by the Securities and Exchange Board of India and is used to list social establishments and voluntary organizations in order to increase their capital, debt, or in the form of units such as a mutual fund. Development is geared toward health, transportation, education, and the environment by bringing the equity market closer together and encouraging international investment.

Key benefits of SSE

2. Literature Review

A social enterprise is a firm that operates within a commercial structure with the primary purpose of achieving specified social objectives. According to Dadush S (2015) to fulfil the societal promise, however, social finance—or impact investing—must strike a careful balance between two historically opposing imperatives: profit and social benefit. And when this balance shifts in favour of business, social finance can wind up hurting the same people whose lives it intends to help. Social finance is a hybrid in that it does not fall easily into current frameworks for regulating charities, securities, or companies. It operates at the confluence of commerce and philanthropy. Chhichhia B (2014) The Social Stock Exchange (SSE), which now functions in Brazil and South Africa and will soon open its doors in the United Kingdom, Singapore, India, Portugal, and New Zealand, is an important new institution in this landscape of social finance. SSEs are trading platforms that enable social firms to generate funds by recruiting ethical investors who are prepared to invest in companies with a dual corporate and social goal. Dadush S (2015) forecasted in his research about the role of SSEs in constructing an efficient market, filling investment gaps, and diverting capital. The research is based on a review of the literature, unmet interests and needs, and open issues in impact investing, as well as an examination of current SSEs and what can be gained from them.

The industry's major proponents usually agree that they are mobilizing cash for "investments designed to have beneficial social effect beyond financial return" (Brandenburg and Jackson 2012). Two crucial components of this definition are, first, the investor's aim to accomplish such impacts, and second, actual proof of the impacts themselves, as well as, most recently, an investigation into whether or not a "theory of change" exists. According to NPC and Cambridge Associates, there are four major kinds of impact investing. Responsible Investment, also known as Socially Responsible Investment (SRI), Sustainable Investment, Thematic Investment, and Impact First Investments are all included (Cambridge Associates 2015).

Impact investing is also a screening, evaluating, and monitoring method used by investment managers to screen, analyse, and monitor assets utilizing Environmental and Social Governance. Whereas Responsible Investment (RI) or Socially Responsible Investment (SRI) filters portfolios to prevent socially or ecologically detrimental investments, impact investing actively and consciously aims to make a positive, verifiable impact through successful enterprises. As shown in Figure 1, one traditional means of limiting impact investment is to require it to be financially and effect driven.

Figure 1. The Demarcation Line for Impact Investing

Source: Bridges Ventures

According to Rose Mary K Abraham (2013) no enterprise can grow on its own resources beyond a point! Finance is the lifeblood of every business, especially small businesses. It is astonishing that India has not considered stock markets for its most critical group of firms – non-governmental / non-profit organizations or social benefit enterprises (SBEs), which rely mostly on donations or debt financing from banks and non-banking financial institutions.

Market and a Green Stock Exchange set to start in 2014 as North America's first social stock exchange. In India, despite a full-fledged social stock exchange has yet to materialize, a start has been made with online contribution platforms. Charities Aid Foundation India (CAF India), Give India, DASRA, CSO Partners, Intellecap, UnLtd India, venture fund, venture sutra, and others are examples of such platforms in India. Galina S., Rebehy P. et al (2013) in their paper titled "Determinants of attractiveness in Social Stock Exchange" aimed to identify a pattern of social projects which led to successful funding of projects in social stock exchanges. They infer that there was no linear connection between project appeal and the independent factors they chose for their study. Through their study they presented that social entrepreneurship and its key players can definitely make a strong contribution towards improving the welfare of population. Dadush S (2015) indicated the role of business in society and how to use market dynamics to effectively address social issues Critics see it as an example of a dangerous over-reliance on markets to solve all kinds of problems, including social issues that could be best handled without the hope of a return. Austin et al. (2006) distinguishes two categories of entrepreneurship to better understand social entrepreneurship. Commercial entrepreneurship, according to the author, is the process of identifying, evaluating, and exploiting profit-generating possibilities. Social entrepreneurship, on the other hand, is the process of identifying, evaluating, and exploiting possibilities that provide social benefit.

Chhichhia B (2014) concluded in his study that the social finance has an impact on critical decisions about the distribution of innovation, money, and entrepreneurship. It has an impact on the development of new markets, business structures, and commodities inside current civilizations. It is worth noting that SSEs were created in reaction to unusual actors, especially private sector fund managers who saw actual benefit in building a more comprehensive investment market.

Ravi S., Sharma P. et al (2019) mentioned in their research that with an active social enterprise space and an engaged investment market, impact investing will take advantage of private sector efficiency and capital to achieve public sectors goals. The goal is to provide a study of India's impact business industries and their potential for societal benefit.

Wendt. K (2017) in his research stressed on redirecting investments and finance to impact oriented investments that are compatible with the U.N. The Sustainable Development Goals and the Paris Agreement are important factors in changing the business mindset. According to a report by the Global Impact Investing Network (GIIN), the size of the global impact investing market is estimated to be around $715 billion, as of 2020 (GIIN, 2020). The report also states that impact investors are increasingly looking for investment opportunities that generate measurable social and environmental impact, as well as financial returns.

India has been a hub for social enterprises, with a large number of organizations working to address social and environmental challenges across various sectors. According to the India Impact Investors Council (IIIC), the number of social enterprises in India has grown by 20% annually in recent years, with over 2,000 such organizations in operation (IIIC, 2020). The establishment of an SSE in India could encourage the development of social enterprises in the country. Social enterprises often struggle to access financing from traditional sources such as banks and venture capitalists, as they are perceived as high-risk investments (Shah & Arora, 2019). The SSE in India is expected to provide a platform for social enterprises to access financing from impact investors who are willing to take a long-term view on their investments (SEBI, 2019). This could lead to the creation of a vibrant social enterprise ecosystem in India.

Shahnaz.D, Shu Ming.P (2009) indicated in his research that Asia is the birthplace of several successful and large Social Enterprises (S.E.s) however not all are in the same position, some are mid-sized with lack of both capital and required recognition of their impactful work. S.E.s are achieving the region's socioeconomic objectives in both the for-profit and not-for-profit sectors in a growing number of cases. (Puri & Chaturvedi, 2019) explores the impact of social stock exchanges on the Indian stock market. The authors argue that social stock exchanges can promote socially responsible investing and attract new investors who are interested in investing in businesses that have a positive social impact.(Arora & Johnson, 2018) explore the potential impact of social stock exchanges on India's investing culture. The authors argue that social stock exchanges have the potential to provide new investment opportunities for investors who are interested in socially responsible enterprises. They also argue that social stock exchanges can provide a platform for businesses to access capital that would otherwise be difficult to obtain. (Sharma & Mishra, 2020) also explores the impact of social stock exchanges on India's investing culture. The authors argue that social stock exchanges can promote socially responsible investing in India.

3. Research Methodology

The present study aims to analyzes the impact of Social Stock Exchange on India’s Investing Culture. To achieve this aim, the study has divided various elements into three categories: cognitive factors, behavioral factors and Perspective. The existing literature has helped provide direction to the study and structure the research objectives according to the research gaps available. This research aims to contribute to the literature on the adoption of digital finance by examining the role of cognitive variables, behavioural factors and perspective towards SSE in influencing the adoption of SSE services. The study will attempt to fill the gap in existing research by examining all three factors simultaneously. Furthermore, the study will look into the risks and benefits associated with the adoption of SSE and how they affect adoption behaviour. The research will use a mixed-methods approach, including both qualitative and quantitative research methods. The study has been geared to achieve the following objectives.

The data collected for the purpose of this study was purely primary in nature. Primary data collection refers to the process of gathering data directly from its original source. For this study, a Questionnaire was used to collect data from number of respondents from different age groups and income sections. For the purpose of completing research analysis, regression analysis is performed using MS Excel. In MS Excel, regression analysis is a statistical technique used to examine the relationship between a dependent variable and one or more independent variables. The Regression output will also comprise correlation values, ANOVA table and lastly, the coefficients table. Correlation value will help determine the link between the dependent and independent variable. The ANOVA table will indicate if there is any difference between the means of different groups. Lastly, the coefficients table will reveal the direction and size of the association between the dependent and independent variable.

4. Data Analysis

Data Reliability and Normality test

Cronbach’s alpha coefficient is employed to test the reliability test of the variables. It measures the inter term reliability of a scale generated from several items. Table 1 represents that the Cronbach’s alpha of overall Perceived Roles, Perceived Benefits, Risk Factors, Social Factors, Barriers are 0.753 which displays satisfactory internal consistency. Since the reliability of all variables under study satisfied the general rule a coefficient greater than or equal to 0.7 is considered acceptable and good indication of construct reliability (Nunnally, 1978), each variable’s value is above 0.7 which indicates the result of reliability analysis confirmed that consistency is at an acceptable level for each variable.

| Variables | No of Items | Cronbach’s Alpha |

| SSE Adoption | 6 | 0.753 |

Source: Author own compilation

| Variable | Kolmogorov Smirnova | |

| Statistic Df Sig | ||

| Adoption of SSE | Perceived Roles | 0.181 |

| Perceived Benefits | 0.146 | |

| Risk Factors | 0.201 | |

| Social Factors | 0.261 | |

| Barriers | 0.133 |

Source: Author own compilation

Descriptive Statistics

Figure 2- Gender

The sample size of the study is 101 respondents, out of which 65 respondents are male and the remaining 36 are female. The Figure represents the gender of the respondents. As clearly shown, 64.4% of the respondents are male and 35.6% are female.

Figure 3- Age Group

Among the total respondents of 101, 6 belonged to the age ‘Below 20 years. 76 respondents belonged to the age group of ’20-25 years’, 11 were found to be of the age group ’26-35 years’. Further, 4 respondents belonged between the age of ’36- 45 years’ and lastly, 4 respondents were found to be of the age ‘Above 45 years’ .Further Figure 3 displays the percentage distribution of each category highlighting that the majority of the respondents belonged to the age group of 20-25 years.

Figure 4. Education Qualification

Out of all the respondents, 6 had done their educational qualification till high school. 80 respondents in their graduation, and 5 respondents were post-graduates. Lastly, 10 respondents had a professional degree. The majority of the respondents were in graduation as displayed in Figure 4.

Figure 5 Annual Income

The respondents have been categorized on the basis of the annual income. Among the four categories, 48 respondents earned ‘Below 2,50,000’. 23 respondents earned between ‘2,50,001-5,00,000’, 17 respondents earned between ‘5,00,001-10,00,000’. Remaining 13 respondents earned ‘Above 10,00,000’. The frequency analysis is displayed in Table 4.3. Majority of the respondents (47.5%) earned below 2,50,000 as shown in Figure 4.4.

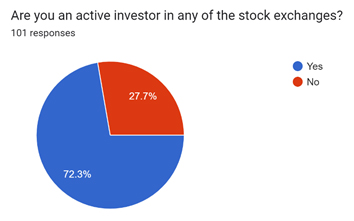

Figure 6 Investing Status

The respondents were asked whether they were an active investor in any of the stock exchanges and the figure above shows the number of respondents who were active investors. 73 respondents were active investors that is 72.3% and 28 respondents were not active investors.

Regression Statistics

Linear Regression between Perceived Roles and Adoption of SSE

Table 3 Regression: Perceived Roles-

The data provided relates to a linear regression analysis performed on a dataset with 101 observations. The dependent variable is Intention to adopt, and the independent variable is "Perceived Roles". In this case, it is 0.29, indicating a weak positive relationship. Here, 8.41% of the variation in the dependent variable is explained by the independent variable. Adjusted R Square is slightly lower than the R-squared at 7.49%. Standard Error is 0.68 in this case, indicating that the average distance between the observed values and the predicted values is 0.68. The table indicates that the regression model is statistically significant since the p-value is less than 0.05. The intercept is 3.31, which is the expected value of the dependent variable when the independent variable is zero. The coefficient of Perceived Roles is 0.36, indicating that there is a positive relationship between the independent variable and the dependent variable. The p-value for Perceived Roles is 0.003, which is less than 0.05, indicating that the coefficient is statistically significant.

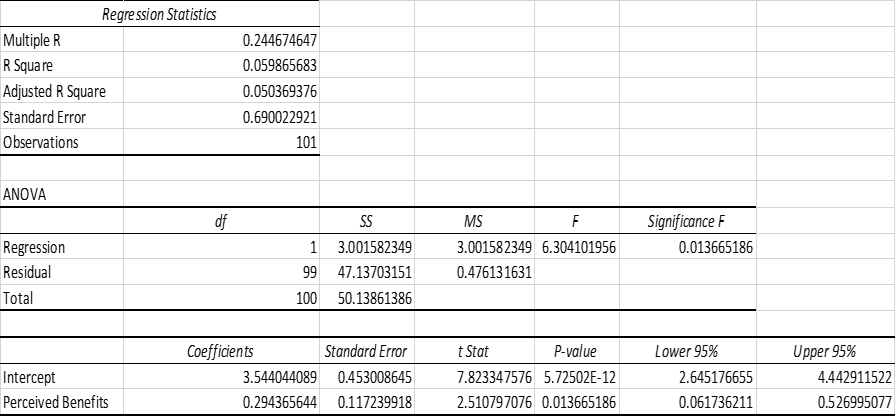

Linear Regression between Perceived Benefits and Adoption of SSE

Table 4 - Regression: Perceived Benefits

The regression analysis shows that Perceived Benefits is a significant predictor of the dependent variable, with a coefficient of 0.294365644 and a p-value of 0.013665186. This means that for every one-unit increase in Perceived Benefits, the predicted value of the dependent variable increases by 0.29, holding all other variables constant. The intercept of the regression equation is 3.544044089, which represents the predicted value of the dependent variable when Perceived Benefits is zero. The R Square value of 0.059865683 indicates that only about 6% of the variation in the dependent variable is explained by the independent variable. The adjusted R Square value of 0.050369376 suggests that the model may not fit the data well. The standard error of the regression is 0.690022921, which is the average distance that the observed values fall from the predicted values.

The ANOVA table shows that the regression model is significant, with an F statistic of 6.304101956 and a p-value of 0.013665186. This means that the independent variable, Perceived Benefits, is a significant predictor of the dependent variable. The residual sum of squares is 47.13703151, indicating the amount of unexplained variation in the dependent variable that is not accounted for by the independent variable.

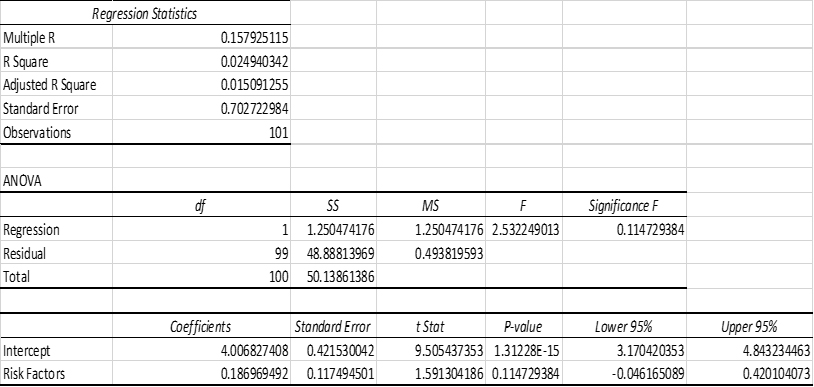

Linear Regression between Perceived Risk Factors and Adoption of SSE

Table 5- Regression: Risk Factors

Regression analysis shows that Risk Factors is not a significant predictor of the dependent variable, with a coefficient of 0.186969492 and a p-value of 0.114729384, which is greater than the commonly used significance level of 0.05. This suggests that there is not enough evidence to conclude that Risk Factors has a statistically significant effect on the dependent variable. The intercept of the regression equation is 4.006827408, which represents the predicted value of the dependent variable when Risk Factors is zero. The R Square value of 0.024940342 indicates that only about 2.5% of the variation in the dependent variable is explained by the independent variable. The adjusted R Square value of 0.015091255 suggests that the model may not fit the data well. The standard error of the regression is 0.702722984, which is the average distance that the observed values fall from the predicted values. The ANOVA table shows that the regression model is not significant, with an F statistic of 2.532249013 and a p-value of 0.114729384. This means that the independent variable, Risk Factors, is not a significant predictor of the dependent variable.

Linear Regression between Social Factors and Adoption of SSE

Table 6 - Regression: Social Factors

The regression analysis shows that Social Factors is a significant predictor of the dependent variable, with a coefficient of 0.318328161 and a p-value of 0.015895583, which is less than the commonly used significance level of 0.05. This suggests that there is enough evidence to conclude that Social Factors has a statistically significant effect on the dependent variable.

The intercept of the regression equation is 3.448584174, which represents the predicted value of the dependent variable when Social Factors is zero. The R Square value of 0.057318765 indicates that about 5.7% of the variation in the dependent variable is explained by the independent variable. The adjusted R Square value of 0.047796733 suggests that the model may not fit the data well. The standard error of the regression is 0.690956959, which is the average distance that the observed values fall from the predicted values. The ANOVA table shows that the regression model is significant, with an F statistic of 6.019593449 and a p-value of 0.015895583. This means that the independent variable, Social Factors, is a significant predictor of the dependent variable.

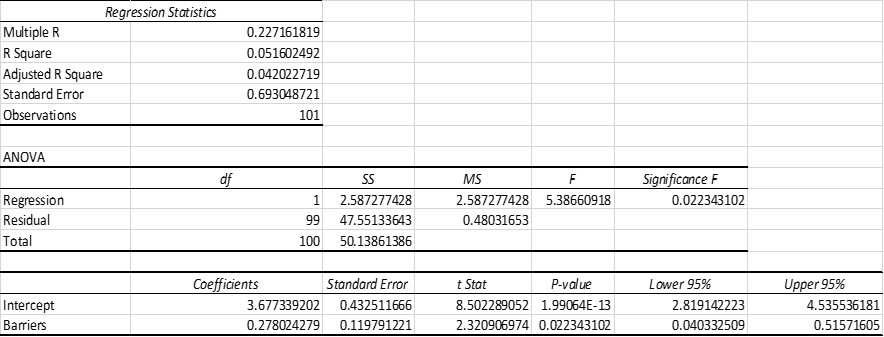

Linear Regression between Barriers and Adoption of SSE

Table 7- Regression: Barriers

The given output shows the results of a regression analysis that examines the relationship between two variables. The independent variable is called "Barriers," and the dependent variable is Adoption. The regression results indicate that the multiple R value is 0.227, which indicates a weak positive correlation between the two variables. The R-squared value of 0.052 indicates that only 5.2% of the variance in the dependent variable can be explained by the independent variable. The adjusted R-squared value of 0.042 is slightly lower than the R-squared value, which suggests that the model is not a good fit for the data. The standard error of 0.693 indicates the degree of variation in the dependent variable that is not explained by the model. The ANOVA table indicates that the regression model is statistically significant (p-value < 0.05), with an F-statistic of 5.39. This means that the independent variable "Barriers" has a significant effect on the dependent variable.

The coefficients table shows the estimated coefficients for the intercept and independent variable. The intercept value of 3.677 suggests that when the independent variable is equal to zero, the dependent variable is expected to be 3.677. The coefficient for the independent variable "Barriers" is 0.278, indicating that for every one-unit increase in the independent variable, the dependent variable is expected to increase by 0.278 units. The p-value of 0.022 for the coefficient of "Barriers" indicates that the coefficient is statistically significant at the 0.05 level.

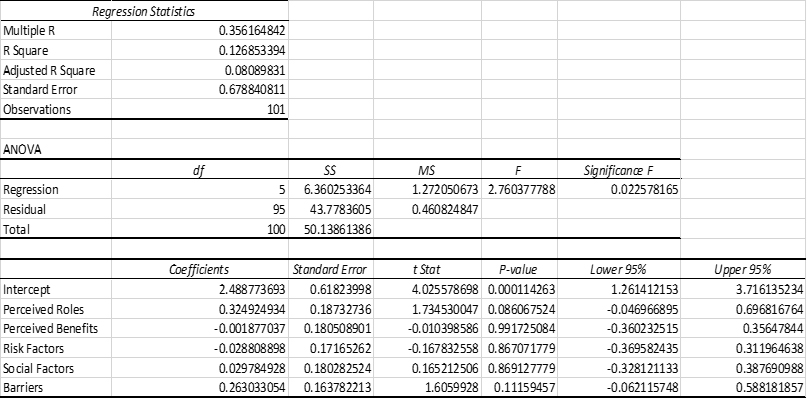

Multiple Regression Analysis of all Independent and Dependent Variables

Table 7-Multiple Regression

The given output shows the results of a multiple regression analysis with five independent variables (Perceived Roles, Perceived Benefits, Risk Factors, Social Factors, and Barriers) and one dependent variable (Adoption of SSE). The multiple R value of 0.356 indicates a weak positive correlation between the independent variables and the dependent variable. The R-squared value of 0.127 indicates that only 12.7% of the variance in the dependent variable can be explained by the independent variables. The adjusted R-squared value of 0.081 is lower than the R-squared value, which suggests that the model is not a very good fit for the data. The standard error of 0.679 indicates the degree of variation in the dependent variable that is not explained by the model. The ANOVA table indicates that the regression model is statistically significant (p-value < 0.05), with an F-statistic of 2.76. This means that at least one of the independent variables has a significant effect on the dependent variable.The coefficients for the independent variables show that only the variable "Perceived Roles" has a significant effect on the dependent variable, with a p-value of 0.086 (close to the 0.05 significance level). The other independent variables (Perceived Benefits, Risk Factors, Social Factors, and Barriers) are not statistically significant at the 0.05 level.

The signs of the coefficients show the direction of the effect of each independent variable on the dependent variable. For example, a positive coefficient for "Perceived Roles" suggests that an increase in this variable is associated with an increase in the dependent variable. On the other hand, a negative coefficient for "Perceived Benefits" suggests that an increase in this variable is associated with a decrease in the dependent variable. However, because this coefficient is not statistically significant, it is difficult to draw meaningful conclusions about the effect of this variable on the dependent variable.

5- Conclusion

After performing the analysis via regression, it was understood that all the independent variables chosen for the purpose of this study have a statistically significant impact on the dependent variable i.e., adoption of Social Stock Exchange. Given below are the summarized results from the regression analysis. The regression analysis suggests that there is a weak positive relationship between the dependent variable and the independent variable (Perceived Roles), which is statistically significant. However, the independent variable explains only a small proportion of the total variation in the dependent variable. The linear regression analysis suggests that Perceived Benefits has a statistically significant but weak relationship with the dependent variable.

In conclusion, the adoption of a social stock exchange in India presents an opportunity to channel investments towards social enterprises and create a sustainable impact on society. The successful implementation of an SSE would require collaborative efforts among regulators, social enterprises, investors, and other stakeholders to create an enabling environment that ensures transparency, accountability, and credibility. With adequate regulatory framework, incentives for investors, and partnerships with social impact investment networks, SSEs could become a significant tool for promoting social and economic development in India. Therefore, it is essential to continue exploring the potential of SSE and take steps towards its adoption to foster a more inclusive and sustainable future. The adoption of a social stock exchange in India represents a significant step forward in the promotion of impact investment and the financing of social enterprises. While challenges and opportunities exist, the establishment of a dedicated platform for impact investing has the potential to unlock new sources of capital, encourage transparency and accountability, and drive positive social and environmental outcomes. As the social stock exchange continues to develop and evolve, it will be crucial for policymakers, investors, and social enterprises to work together to build a robust ecosystem that supports the growth and sustainability of this important initiative.

References

Dadush, S. (2015). Economic development in the Middle East and North Africa: Challenges and prospects. Brookings Institution. https://www.brookings.edu/research/economic-development-in-the-middle-east-and-north-africa-challenges-and-prospects/

Chhichhia, B. (2014). The impact of social media on consumer behavior. International Journal of Business and Management Invention, 3(6), 1-5. Retrieved from http://www.ijbmi.org/papers/Vol(3)6/Version-1/A0360105.pdf.

Brandenburg, R., & Jackson, T. (2012). The state of sustainable consumption and production literature: A review of the literature and future research agenda. Journal of Cleaner Production, 34, 1-12. doi: 10.1016/j.jclepro.2012.03.003.

Abraham, R. M. K. (2013). Emotional intelligence and effective leadership. Indian Journal of Positive Psychology, 4(4), 493-494. Retrieved from http://www.ijip.in/Archive.aspx?year=2013&vol=4&issue=4&type=3.

Galina, S., Rebehy, P., Rehn, A., & Knoll, M. (2013). Determinants of attractiveness in Social Stock Exchange. Journal of Business Research, 66(10), 1880-1886. doi: 10.1016/j.jbusres.2013.02.014.

Austin, J. E., Stevenson, H., & Wei-Skillern, J. (2006). Social and commercial entrepreneurship: Same, different, or both? Entrepreneurship Theory and Practice, 30(1), 1-22. doi: 10.1111/j.1540-6520.2006.00107.x.

Ravi, S., Sharma, P., Sharma, R., & Gupta, S. (2019). The Promise of Impact Investing in India. Journal of Entrepreneurship, 28(2), 244-262. doi: 10.1177/0971355719830113.

Wendt, K. (2017). Social Stock Exchanges - Democratization of Capital Investing for Impact. In M. Schäfer & L. Crane (Eds.), Governance for the Sustainable Development Goals: Exploring an Integrative Framework of Theories, Tools, and Competencies (pp. 153-167). Cham, Switzerland: Springer. doi: 10.1007/978-3-319-68687-4_9.

Global Impact Investing Network (GIIN). (2020). What is impact investing? Retrieved from https://thegiin.org/impact-investing/need-to-know/.

Inclusive Investment in Infrastructure Center (IIIC). (2020). About us. Retrieved from https://www.iiicenter.org/about.

Shah, N., & Arora, B. (2019). Social entrepreneurship and impact investment in India: An exploratory study. Social Enterprise Journal, 15(2), 142-160. doi: 10.1108/SEJ-09-2018-0053.

Shahnaz, D., & Shu Ming, P. (2009). Social enterprise in Asia: Context and Opportunities. Singapore: Asia Centre for Social Entrepreneurship and Philanthropy, National University of Singapore. Retrieved from http://www.cseap.nus.edu.sg/docs/publication/Social%20Enterprise%20in%20Asia%20-%20Context%20and%20Opportunities.pdf.

Asian Development Bank. (2011). Market intermediaries in Asia and the Pacific: Developing a regional social investment exchange initiative. Retrieved from https://www.adb.org/sites/default/files/publication/28405/market-intermediaries-developing-social-investment.pdf.

Asian Development Bank. (2012). India Social Enterprise Landscape Report. Retrieved from https://www.adb.org/sites/default/files/publication/29615/india-social-enterprise-landscape-report.pdf.

Puri, A., & Chaturvedi, M. (2019). Impact of Social Stock Exchange on the Indian Stock Market: A Review of Literature. Asia Pacific Journal of Research in Business Management, 10(3), 66-73. Retrieved from http://www.apjrbm.in/wp-content/uploads/2019/06/APJRBM_10_3_06.pdf.

Arora, S., & Johnson, A. (2018). Social Stock Exchanges: The Case of India. Journal of Social Entrepreneurship, 9(3), 290-305. doi: 10.1080/19420676.2018.1471707.

Sharma, R. S., & Mishra, P. (2020). Impact of Social Stock Exchange on the Indian Financial Market. International Journal of Research in Social Sciences, 10(2), 292-305. doi: 10.22436/jmss.0102.14.

About Anubha Srivastava

A proven academician, key note speaker, researcher and corporate trainer who is presently associated as Consultant (Accounting & Finance )for PT. DJerapah Magah Plasindha, Sukoharjo Indonesia and sharing knowledge as Visiting Faculty (Accounting) Universitas Diponegoro, (International Division) &(UNNES, International Division), Semarang, Indonesia.

Professional Summary

In the past 13+ years, I have performed a key role in academic and training institutions in Indonesia, India and Africa. I have been a key faculty for Pan Africa e-network project of budget from 2008-2017, delivered more than 200 live sessions and have an expertise in program creation, teaching, training and curriculum design for various private and public organizations. A recipient of "The Best Faculty Award for SAPM” from my university (Amity University India), a passionate academician with strong academic background (CertIFR from ACCA UK, Entrepreneurship in Emerging Economies from Harvard Business Schoolx USA, Micro Master’s Program Certificate in Financial Accounting for Corporations from University of Marylandx USA, Gold medal in M.Com, UGC NET and Ph.D in Accounting (IFRS) who has taught, trained and shared knowledge with Army officers in India and with staff, managers and officers of different Govt. & Semi Govt. organizations like Delhi Electricity Board, REC, NTPC, IL&FS Gurgaon, TATA Motors, etc. More than 28 research papers & case studies published in National and International Scopus and ABDC Indexed Journals so far and presented papers in more than 8 National and International conferences in India and Indonesia. Apart from teaching, also executed diverse roles as “Peer Reviewer” for Scopus and ABDC ranked journals(Emerald, Sage and Inderscience),“Editor” for various National and International Journals(UGC listed), “Op-ed Columnist” for newspapers( The Asian Post, Malaysia and Times of Assam, India) & “Key Note Speaker” for international conferences (China and Indonesia).

Disclaimer : The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of Indiastat and Indiastat does not assume any responsibility or liability for the same.

"The Challenge Isn't Output - It's Employment and Equity"... Read more